Building trusted customer relationships for businesses worldwide

Technology built for customers and businesses to easily transact with trust

Lightning fast and secure onboarding

Verify the identity of your customers in seconds with minimal friction to quickly convert prospects into valued customers and reach your acquisition goals.

Seamless step-up authentication

Escalate to higher levels of assurance, closing the gap on hard-to-identify individuals and reducing drop-off to keep more customers in the pipeline for conversion.

Reverification without friction

Enable easy access and prevent fraud with reverification that requires minimal customer effort and provides a trusted experience.

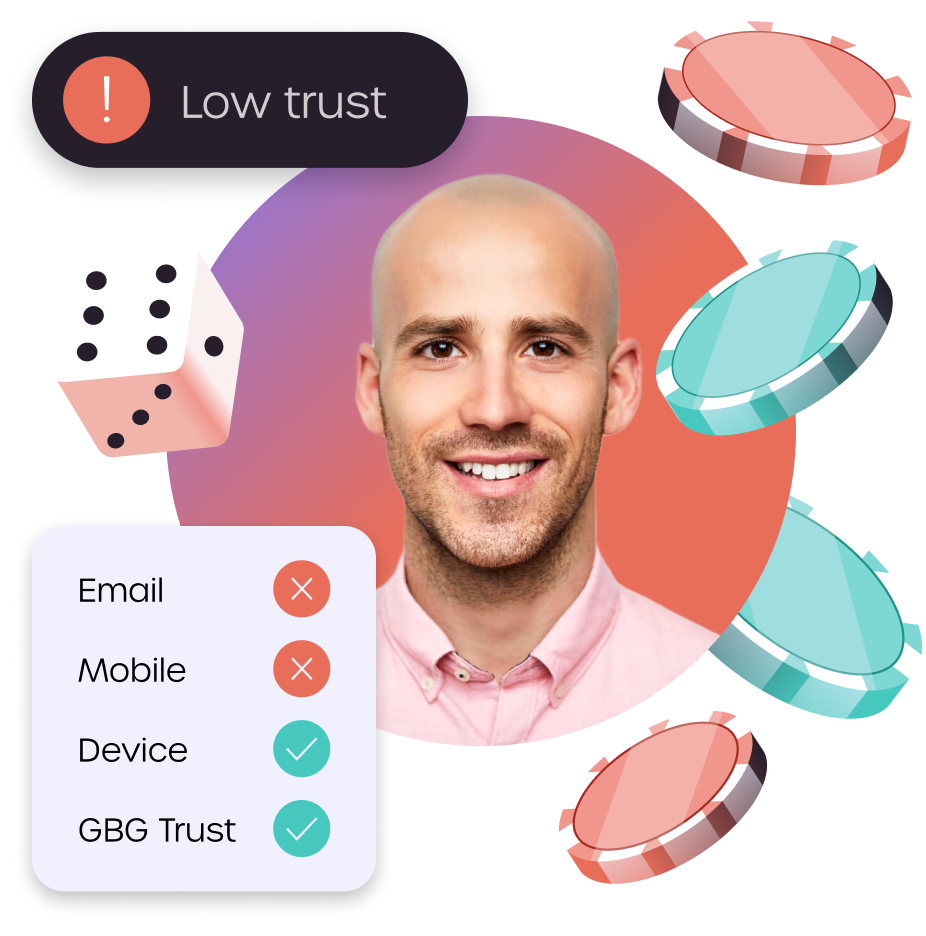

Always on risk monitoring

Stay a step ahead of fraud and suspicious activity using predictive risk intelligence to continuously monitor transactions and identities that change over time.

Trust a proven global provider

Innovative, proven and trusted

20+ years of experience serving industry leaders with technology, data and intelligence orchestration

End-to-end solutions

Ready-made or custom workflows from front-end to back, integrate point solutions or the entire platform

One stop service provider

Everything in one place to be compliant and fight fraud with one vendor, one contract, one API

Extensive global coverage

Verify almost anyone with billions of data records, one of the industry’s largest ID libraries and biometrics

Omnichannel deployment

Cloud, on-premise, API and no code integration options to balance agility, privacy, resources and cost

Personalized support

Committed to building long-standing customer relationships through responsive service and support